IHS Markit

Global semicon chip sales plunges 13.9pc in H1 2019; 5.5pc growth forecast for 2020

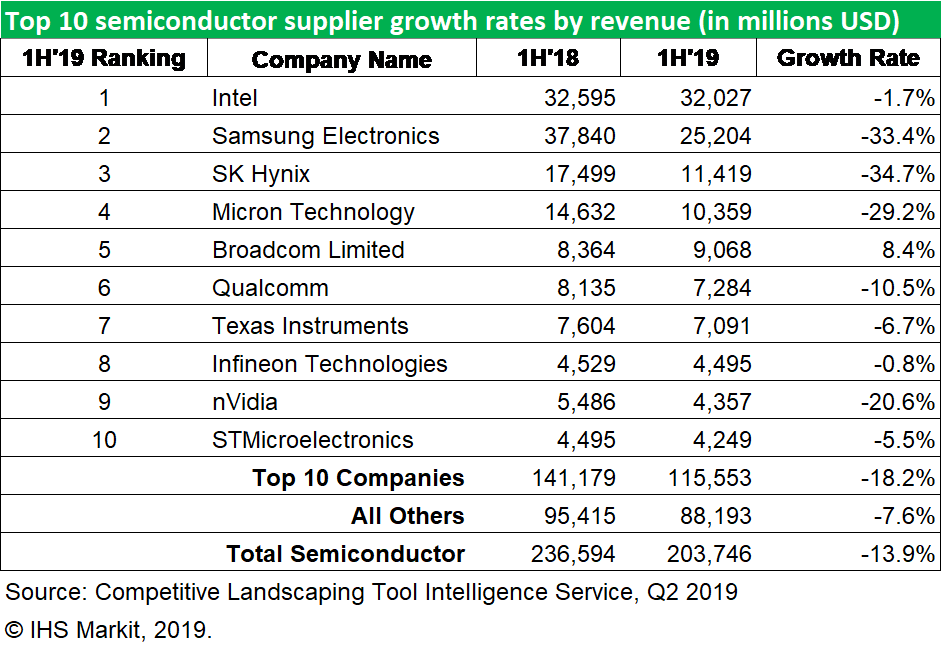

Global semiconductor chip sales plunged by 13.9 percent during the initial six months of 2019, compared to a year earlier, the biggest drop in a half since the first half of 2009 — exactly a decade ago, according to IHS Markit.

Major chip suppliers suffered their worst revenue declines in years—10 years in some cases. Major semiconductor product areas also experienced the largest drops in demand since 2009.

Global semiconductor revenue in the first half totaled $203.7 billion, down from $236.6 billion in the first half of 2018. This represents the worst performance since the market declined by 26.5 percent in H1 of 2009.

Chip debacle?

First, wasn’t the chip debacle expected? Yes, said Ron Ellwanger, senior Research analyst, IHS Markit, USA. “In late 2018, IHS Markit had forecasted a significant decline in semiconductor revenue in 2019. Semiconductor inventory was high and demand was weak. We didn’t foresee any compelling new product to stimulate consumer demand and growth.”

So, what is the main reason for the precipitous drop in memory segment? And, is there a way out? According to Ron Ellwanger, they are overcapacity and weakend market demands. As the datacenter and handset markets recover, the existing capacity will be in utilized.

Again, what are the reasons for the drop in data processing? He said that data processing tends to refer to the PC market. The PC market continues to be negatively affected by smartphones. Servers and data centers were simply overbuilt. “As capacity is utilized, the next wave of build out will occur. We expect that to start in early 2020.”

Next, what are the reasons for the revenue declines in logic, sensors and actuators? Ellwanger said that there was a lack of new products that captured consumer interest, which increases demand. This caused the chip companies to see a decline in their orders. The market needs new compelling products for consumers to re-enter the market.

Is there any advice for the application markets that purchase semiconductors? He noted that application markets must develop new products that stimulate consumer’s desire to acquire the new device. Evolutionary products are not causing consumers to purchase the next generation gadget.

Forecast 2020

Finally, what is IHS Markit’s forecast for the global semicon industry for the end 2019, and full 2020? Ellwanger said: “The current IHS Markit forecast will be updated by the end of September 2019. Our existing forecast for 2019 is -12.5 percent, and we anticipate that this may further degrade.

“The current forecast for the global semiconductor industry for 2020 is 5.5 percent. We believe that this will be in the range of our new forecast.”