Data centers

Digital technologies shaping sustainable, resilient future: Schneider Electric

Schneider Electric organized the Virtual Innovation Day India 2021 today. Pankaj Sharma, EVP, Secure Power, Schneider Electric, spoke about Electricity 4.0 and how digital technologies will shape a more sustainable and resilient future.

Sharma said we are now looking at electricity 4.0. We are looking at how digital technologies can shape a more sustainable and resilient future. We can digitize electrical distribution. Technology that enables us to do all that exists today. Electricity 4.0 is powering the new electric world.

Data centers allow us to build a smart future. There are needs for them, such as sustainable, efficient, and adaptive. They also need to be resilient. Data centers are at different levels of maturity across the four vectors. Schneider has the expertise to do all of this. We are boosting innovation in our core, while expanding in digital. We are working across power and grid, infrastructure, etc.

A customer in North Africa has reduced power consumption by 35 percent. Electricity 4.0 can shape a zero-carbon future much faster. We provide impactful thought-leadership content spanning edge computing, sustainability, Industry 4.0, and data center resiliency.

It’s a matter of trust!

Ms. Rachel Botsman, Trust Expert, Lecturer and Author, spoke about the currency of trust. Technology is transforming trust. She gave an example of AirBnB. The ability of technology is to unlock the value of assets in many new different ways. Today, AirBnB is worth more than four largest hotel chains combined.

Money is the currency of transactions. Trust is the currency of interactions. Trust is the confident relationship with the unknown. Swimming between the sea of uncertainty between known and unknown is all about trust. Trust leaps are changing behaviors. We are now giving our trust to machines via biometrics, automation, AI, etc.

We need to identify the key trust barriers. We need to ask: what trust states are the people in? She demonstrated a woman in self-driving car asking for driving controls be transferred to her. Human instinct is to go to the known, safe, and familiar. So, how can you make the new feel familiar? What are the different trust layers? We need to trust other people, an idea, or a platform. Behind most innovation, there is some form of trust in a platform, or, a technology platform.

Finally, we need to earn trust. How do I build more trust? There are capability and character. Competence and reliability looks at capability. Integrity and empathy looks at character. These are the key components of earning trust.

Sustainable digital transformation

There was a panel discussion around sustainable digital transformation. The participants were Aaron Binkley, Head of Sustainability, Digital Realty, Eric Lim, Chief Sustainability Officer, United Overseas Bank (UOB), and Ms. Esther Finidori, VP, Environment, Schneider Electric. Ms. Natalya Makarochkina, Secure Power SVP International, Schneider Electric, was the moderator.

Ms. Esther Finidori, Schneider Electric, said that they are coordinating programs and trust across the company. Aaron Binkley, Digital Realty, said we have seen significant changes in the data center industry. Eric Lim, UOB, added that finance plays a critical role in driving sustainability. It has gone mainstream. We adopt a customer-centric approach. We do this through multiple views: smart city, green, etc. We continue to see lot of interest from customers. Binkley said we need to look at the electricity consumption.

Ms. Finidori noted, at Schneider, they reduced CO2 emissions by 60 percent. They are helping customers and suppliers achieve the same. Schneider has created a new division for customers to help achieve their sustainability goals. Binkley added they have programs for customers. They look at RoIs across portfolios, whether energy, green buildings, etc.

Ms. Finidori said developers need to create new renewable capacity in the grid. PPA contracts are complex. They enable companies to deliver clean, renewable energy. Binkley noted that there is more action happening in the grid. There are ways to differentiate products, etc. Lim said banks would be keen to finance a renewable solution.

Binkley said we have seen commitments happen. Companies are in the journey for sustainable commitments. It is easier, and harder, for companies in different sectors to decarbonize. Ms. Finidori said each sector has specific focus on sustainability. Eg., textile and consumer goods have different focus. Schneider is focusing on green innovation. Lim said we have been able to demonstrate a path to net zero for the bank. The good news is that Singapore-based banks are leading. Corporates are also starting out in this space.

Ms. Finidori said sustainability has brought in lot of innovation. We are accelerating our strategy. As for edge data centers, there is huge potential for efficiency. You have to consider all the climate pledges being made. We forecast no increase in CO2 emissions. Digital capabilities need to be leveraged for sustainability.

Lim said finance emissions are difficult to manage. We are trying to build ESG profiling tools. We need to understand that this is a journey. We need a good dose of alignment, commitment and time. Binkley said we are focusing on scope-1 and -2. Ms. Finidori added that we need more qualitative data. We need to go to a new way of looking at data. We need sustainable data that is available to all the companies.

GlobalFoundries on impact of pandemic on semiconductor industry

ASMC 2021 day 2 began with a keynote: A reflection on the impact of the pandemic on the semiconductor industry, delivered by Dr. John Pellerin, VP and Chief Technologist, GlobalFoundries.

Looking back on 2020 Covid-19 has been a catalyst regarding megatrends. Foundries are changing an industry that is changing the world. The global GDP is $91 trillion, of which electronics is about $2.3 trillion, semiconductors is $563 billion, including memory, and $86 billion is for foundry, including IDM foundry.

How was 2020 like?

Some predictions of 2020 for semiconductors were quite bleak. There was a foreshadowing of possible unusual dynamics. Some shifts in work processes and consumer behavior that arouse during the pandemic might persist, and open new markets and routes to markets. Looking back reflected a different outcome for semiconductors overall. The estimated 2020 to 2021 growth was 11-12 percent or $504 billion.

Covid-19 and stay-at-home economy significantly increased chip demand. Six out of eight segments beat the pre-Covid-19 estimated. Wireless, PCs, storage, GPUs and peripherals, consumer electronics, servers, and wired beat expectations. Only industrial and automotive failed to beat the estimates. In the auto chip market, the pandemic created unprecedented shifts in global semiconductor demand. There were sudden and significant decrease in semiconductor auto sales in Q2-2020. This was followed by an equally steep and sudden rise in H2-2020. The deep trough didn’t last long.

2020 was like living a decade in a year. Technology enabled a better normal. The 5G super cycle was here. There were changes in global trade, creating tailwinds in the global semiconductor industry. There was accelerated global demand. Over a billion people have worldwide 5G coverage. There was over 50 percent mobile network data traffic increase. There were 200+ billion hours of additional video traffic. Covid-19 was a catalyst for these astounding statistics.

In 2020, there were record production output and wafer starts. GlobalFoundries was also listed among America’s safest companies. We had to put in geography-specific crisis management teams and protocols. There were Covid-19-specific employee leave programs, and worker arrangements for closed borders. There was continuity and growth of operations amidst extraordinary and difficult global circumstances. 2020 was a strong year from a business perspective.

Lessons from 2020 pandemic playing forward to the strong 2021 demand cycle, included supply fragility. PPE shortages started in January. There was big push for IT equipment through all channels. Safe stock levels of parts and raw materials were challenged. Logistics disruptions saw border closures impacting people and goods moving. Air cargo running on passenger flights were impacted. GlobalFoundries was deemed essential, and extended to 30+ suppliers globally.

There was semiconductor demand surge and permanent demand shift in 2021. In 2021, we began with supply fragility, with diversity and redundancy, not just capacity. There were wafer starts and packaging laminates, etc., under pressure, due to deeper and longer supply agreements, and having coverage over the optimization and efficiency. For capex lead times, there was the equipment productivity improvement of the existing assets. Tom Weber, SVP, said ‘no wafer start left behind.’

Megatrends post 2020

Covid-19 has served as a catalyst. The megatrends accelerating after 2020 include frictionless networking, virtualization, and hierarchical AI. For frictionless networking, the last hop is always RF/wireless. Core is always optical. There is real-time (edge) remote processing, and everything is part of a seamless network.

Semiconductor requirements include RF PA, switch and LNA performance, integration of software/LNA/PA, integrated photonic ICs, and low power RF with embedded memory. Key semiconductor innovations include photonic SoC integration, efficient, high power PA, THz SiGe and SoI integration, and wide band gap.

For virtualization, there are brontobytes of data manipulation, memory and compute converging, photonic and quantum compute, and disaggregated storage solutions as market implications. Semiconductor requirements include ultra-low power computing, imaging, and display, and data transport, open source scalable secure protocols, co-packaged heterogenous systems, etc. Key semiconductor innovations include optical compute, co-synthesized logic and memory, 2.5D/3D hetero-interconnect, and THz SiGe/SoI/CS.

For hierarchical AI, market implications include voice commands and processing at the edge, AI embedded in devices, and explosion of edge devices (industrial IoT). Semiconductor requirements include security, reliability and failover management, and speed, especially, shorter response times. Key semiconductor innovations include platform for efficient and comprehensive integration.

DCs, auto, 5G/6G

These megatrends apply to specific segments, such as data centers, automotive, and 5G/6G. Data centers are on a power collision course. By 2040, computing will use 100 percent of world’s energy production. There are missions ongoing to flatten the power consumption curve, with novel compute architectures, optical networking, and AI everywhere.

Megatrends are driving innovation in the data center. A disaggregated approach will see more of optical networking, low-power connectivity, efficient power delivery, novel compute architectures, and higher utilization and reduced power, leading to lowered TCO.

There are silicon photonics solutions in the data center. There are pluggable modules for DCs and co-packaged optics or DC interconnects. SiPh today, is from 10km to metro DWDM (400G), upto 2km (400G), and 100-500m (40G-100G). Cu today is transitioning to SiPh. SiPh is becoming the key enabler for data centers.

In computing, novel compute architectures are delivering More than Moore. They are delivering high performance without scaling. There are paradigm shifts with photonic super computing and quantum photonic computing.

GlobalFoundries solutions for moving, connecting, and storing data from edge to cloud, include silicon photonics solutions, SiGe BiCMOS for high-speed interconnectivity interface, and key technologies facilitating the disaggregation of computing, storage, and data transfer to reduce capex and opex.

For automotives, key trends include connectivity, electrification, and safety and automation. New vehicle architecture includes next-gen zonal architecture such as smart sensors, advanced compute and AI, and new infrastructure for power and connectivity. Each zone is responsible for each system.

Smart sensors include ADAS radar, and ADAS LiDAR. In compute and AI, there are advanced AI systems, zone controls, and infotainment. For infrastructure, there is battery management and EV drive control, safe/secure wireless data, and high-speed in-vehicle data. There should be a closer relationship between the foundry and the auto industry. This will lead to direct working exchange, engineering collaboration, and strategic planning and investments. We can drive supply chain to the technology of choice.

For 5G and 6G, we are in the early stages of 5G. 6G will arrive after 10 years. For 6G frequencies, over 100GHz means that technology development must start early. We will use mmWave for 5G and 6G. Huge amounts of spectrum is available for 100-300GHz. This is an enabler for communications and sensing. Large bandwidth and smaller wavelength will be used. W and D bands are the leading contenders. 6G will also drive new RF technology.

For 5G, GlobalFoundries has solutions such as 45RFSoI and 22FDX. There is unparalled 5G mmWave FEM performance. For 6G, silicon is capable at D band ~15dBm, but PAE is low. In InP, best Pout and PAE, but lacking high-volume commercial availability. Scaled GaN has highest power density and high Pout at ~25dBm. As for SiGe, there is a 600GHz roadmap for significant improvement in high-frequency performance. Putting 6G in context, it will be 10-100x better over 5G in figures of merit.

Looking at the future of communication, future networks will be driven by intelligent edge nodes based on high speed, always-on devices. Technology innovations are needed to leverage a vast, untapped spectrum (100GHz-1THz). Innovative RFSOI, FinFET, and SoI/SiGe-based photonics are the platforms for the future.

In summary, the semiconductor industry continues to show leadership, adaptability, and resilience in times of this crisis. Pent-up demand is compounding upon an already growing base. The megatrends intersect the critical segments of the global economy driven by semiconductors: data centers, automotive, and 5G/6G. A diversity of semiconductor solutions are critical for driving the global economy.

Global technology trends impacting optical transceivers market

Yole Développement, France, recently organized a seminar on key global technology trends impacting the optical transceivers market. Dr. Martin Vallo, Technology & Market Analyst, Lighting, Yole Développement, presented the macro-trends, such as traffic growth and market drivers.

The global device and connection growth between 2018-2023 is largely from M2M (33-50 percent), smartphones (27 percent), non-smartphones (5-14 percent), TVs, PCs, tablets, etc. By applications, between 2017-2022, Internet video leads (55-71 percent), with IP VoD (11-20 percent), web/data, file sharing, gaming, etc.

Global traffic growth is mainly driven by high-resolution video streaming services. Data-centric apps include cloud services, industrial automation, HD video streaming, etc. There are emerging apps, such as AR/VR. Demand for the highest speeds comes from metro networks today.

Looking at the app trends, there is the status of migration to higher speed in optical transceiver datacom. At 400G, there is faster Internet, with faster interfaces. There are throughput improvements on the electrical and optical sides. There is also the price performance of hyperscalers. Penetration rate of DC optical transceiver modules by data rates will increase by 37 percent for 400G and beyond by 2026.

Looking at the optical transceiver technology trends, there is laser usage, from

- Short-reach (0 to 100 meters): higher bandwidth VCSELs.

- Intermediate reach (500 meters to 2 km): silicon photonics/EML.

- Long-reach (10 km and beyond): DML(DFB)/EMLs low-power coherent optic.

There has been modulation evolution, as well. There is four-level pulse amplitude modulation (PAM4). There is standard for medium- and long-haul serial data links that run >50 Gbps per lane. PAM4 is still expensive. For quadrature amplitude modulation (QAM), the advantage is to transmit more bits per symbol. It is only for coherent technology (sufficiently high signal to noise ratio). For optical transceivers, there are the on-board optics (OBO) / co-packaged optics (CPO).

The optical modules strategy for vertically integrated market is the Epi-wafers, laser sources, modulators, drivers, and amplifiers, and integration platforms (InP or SiPh). Between 2020-2026, the optical transceiver market revenue will increase from $4.2 billion in 2020 to $13.8 billion in 2026 for datacom, at CAGR 22 percent. It will increase for telecom from $3.9 billion in 2020 to $6.1 billion in 2026, at CAGR 8 percent.

PS: On a personal note, with profound grief, today, we have lost Shankar Ghosh, or Keshtoda, to Covid-19. He was my guru from my young days. I recall my first ever article, at 14, published by him at Pragati Manjusha, Allahabad. May you rest in peace, dear Keshtoda.

Semiconductor outlook 2021 — navigating through turbulent times : Part 2

Here is part two of the SEMI Silicon Valley Chapter and SEMI Northeast Chapter conference on semiconductor outlook for 2021.

Turbocharged digitization

Dan Hutcheson, CEO, VLSI Research, presented on how the pandemic has turbocharged digitization. There are macro factors driving the semiconductor industry. Covid-19 closed one door and opened another. We have since gone from rainy situation to a sunny situation. The semiconductor industry had prepared the world for Covid-19. This year has started really strong. IC market growth has been slowing because of Covid-19.

This year, VLSI Research’s forecast for semiconductor equipment industry is about 20 percent. Zooming in on critical IC market segments, semiconductor sales growth should be +13 percent.

Focusing on IC market growth this week, the 13-week MA shows 2021 has kicked off on a strong growth path. Unlike the last 2 years, DRAM, NAND, auto, analog logic, and power are in a tight growth pattern – most recently ranging from +14 percent to +19 percent. In 2019, DRAM and NAND sung the blues after a hot 2018. 2020 was the year for auto ICs to be blue. With all the news of an auto IC shortage, this market is clearly hot. The auto IC sales are forecast to grow 21 percent. Seeds of auto IC shortage in 2020 were sown in poor supply chain management.

DRAM is very data-driven and forecast to grow 21 percent. NAND IC sales is forecast to grow 15 percent, as well. Analog IC and power discrete sales is forecast to grow 12 percent. Logic IC sales is forecast to grow 10 percent.

IC supply/demand trends

Looking at the IC supply/demand trends, IC wafer fab production levels continued to rise last week at ~20 percent above 2020 levels, with production levels above 2M 300mm equivalents per week. Supply/demand status held tight for the week. DRAM jumped, NAND and IDM tightened, while foundry, OSAT, and analog and power loosened. The 1Q nowcast is tight

In semiconductor utilization, all sectors are high. These include wafer fab, test, and packaging. Electronics’ prices are also declining. These include TVs, PCs, notebooks, tablets smartphones, cell phones, digital cameras, appliances, etc.

Looking at semiconductor inventory, the inventory-to-billings ratio is in an expansionary range, and ~0.25 below critical levels. Total IC inventories are in decline, suggesting high fear levels at the start of 2021.

Semiconductor/semiconductor capital equipment 2021 outlook

Harlan Sur, Executive Director, JP Morgan, presented semiconductor/semiconductor capital equipment 2021 outlook and long-term trends. Semiconductors/semicap stocks have outperformed the market over the last 1, 3, 5, 10 years.

Drivers of the strong stock performance include the realization that semiconductors are the foundational building block for all innovation in the technology sector — applications/devices/appliances are getting more intelligent and requiring higher levels of semiconductor $ content. There is lower cyclicality in the industry driven by end-market diversification and disciplined supply growth. Lower cyclicality drives more focus on profitability and free cash flow expansion, leading to strong capital return to shareholders.

Industry consolidation (M&A) is expected to drive diversification, R&D scale, and enhanced profitability and capital returns. Near-term, there is positive Y/Y inflection in semiconductor company revenues in 2H20, and expectations of industry growth through 2021. We expect long-term positive fundamental trends to continue going forward. Semiconductors have been in more stable growth phase. There is focus on market leadership, strong product cycles, margin/free cash flow expansion, and capital allocation.

End-market diversification and lower industry cyclicality drives more focus on profitability and cash flow. As operating margins and free cash flow margins have expanded, companies put in place strong capital return programs, driving higher valuation multiples. Industry consolidation has driven valuation multiples higher over time.

Cyclical trends

Semiconductors/semicaps growth and cyclical trends remain positive entering 2021 and beyond. We believe the semiconductor industry has entered a more stable and less cyclical growth phase characterized by low- to mid-single-digit annual revenue growth and high-single-digit unit growth. With the industry generally driving high-single-digit Y/Y unit growth, the entire value chain is able to better predict silicon consumption requirements, better respond to perturbations in supply/demand, and more efficiently plan manufacturing output. As a result, volatility in semiconductor supply/demand and semiconductor equipment spending has muted significantly.

Compare this to 15-20 years ago, when unit growth rates were +15 percent Y/Y – small perturbations in supply/demand would drive significant swings in inventory, shipments, capacity planning, and equipment spending. Bottom line: The current environment is likely more stable and less cyclical for semiconductor and semiconductor capital equipment suppliers. In a maturing industry, we believe the market will focus on market leadership/scale, operating margin and free cash flow margin expansion, and increasing payout ratios.

We see the semiconductor industry revenue up 10-12 percent Y/Y (bias upward) in 2021, following a 7 percent Y/Y growth in 2020. If you recall, the 2H20 demand picked up significantly and growth turned positive after 1H20’s weak demand environment and supply chain disruptions (Covid-19). In semiconductor equipment, we see spending up ~16 percent Y/Y in 2021 led by DRAM and foundry strength.

As for supply constraints across all end markets, we see multiple quarters of strength for the semiconductor suppliers. Channel/customer inventories are at/near historic lows, and lead times are continuing to get stretched out. Given the strong demand environment combined with supply tightness, we anticipate strong demand trends through 2021.

We expect continued industry consolidation (M&A). There is focus on scale, diversification, and margin and FCF expansion. There is promising outlook for foundry/memory in 2021, with demand and capex spending driving strong semiconductor equipment fundamentals. Potential investment in US domestic manufacturing capability is a positive, with innovation and assurance of the supply base.

Industry consolidation should also support valuations. We can expect more M&As to happen. Semiconductors are consolidating focus on building scale and driving profitability improvements, End-market diversification, etc. Consolidation should drive more stable revenue growth and improve margins. Less competition leads to less pricing pressure. There will be more market leadership and diversity. In 2015-2018 have seen $100 billion+ per year in M&A deal activity vs. the $20-30 billion run-rate prior to this time period.

M&As are characterized by big getting bigger. Going forward, we expect to start seeing a lot more M&A activity with the smaller/medium-sized companies, as there is pressure to drive scale to compete with much bigger competitors.

Data center fundamentals strong

Strong data center fundamentals, led by cloud service provider (CSP) spending are driving strong demand for compute, networking, and memory/storage semiconductors.

Look for companies levered to data center trends to outperform in 2021 across compute, networking, and storage/memory after digestion cycle in 2H20. CSP spending (top 4) grew by 10 percent in 2020 and was up 6 percent in 2019. We expect cloud spending to reaccelerate in 1H21 and grow 25percent+ in 2021, and at 10-15 percent CAGR over the next few years.

Cloud services revenues continue growing >40 percent + Y/Y. Over the next 5 years, CIOs should grow spending on public cloud by 4x. Early ramp of new processors by Intel, AMD, Nvidia, and ARM will see adopters. Silicon switch ports (>25Gbps) should grow 23 percent CAGR. DRAM memory content in a cloud server is 50 percent higher than traditional enterprise server – OW MU. Data center compute acceleration is growing >25 percent CAGR, driven by higher complexity workloads (AI/Deep Learning, analytics, etc.).

Resurgent custom chips

Custom chip (ASIC) market is experiencing a resurgence in activity as large OEMS, cloud, and hyperscalers look to differentiate at the silicon level — $10-$12 billion silicon market opportunity. Demand is rising for custom ASICs as many large OEMs/CSPs/hyperscalers are looking for more differentiation, better performance, lower power consumption and overall lower cost of ownership versus off-the-shelf chip solutions (or ASSPs).

These same customers do not have the capabilities to do large complex SoC) designs, nor do they have the broad IP portfolio of on-chip design blocks, like high-speed SERDES capabilities or high-speed memory interface technology. They need to engage with semiconductor companies (ASIC companies) that have the IP and chip design expertise (Broadcom, Marvell, Intel, MediaTek as examples).

The digital custom ASIC chip market is a ~$10-$12 billion per year market opportunity. These include cloud/hyperscale ASICS (AI processors, smartNICs, security/video processors, networking/storage acceleration). Telco/service provider equipment OEMs also see growth, for 5G base station modems, 5G digital front ends, 5G MIMO/beamforming DSPs, and coherent DSPs for long haul/metro.

There are 5G opportunities too. These benefit wireless infrastructure and wireless RF smartphone market leaders. 5G base station deployments are growing by more than 22 percent CAGR (2020-2023E). 5G base station estimates are growing from 2020’s ~800k to 2023’s ~1400k. We expect North America activity to pick up in second half of the year followed by Europe in 2022.

Digital semiconductors are growing from ~$3 billion in 2020 to ~$4 billion in 2023. Analog semiconductors will grow from $0.8 billion in 2020 to $1.1-$1.2 billion in 2023. This is a positive for players like Broadcom, Marvell, Intel, Analog Devices, Xilinx, Qorvo, NXP, etc. Massive MIMO/Beamforming are key enablers of 5G sub-6 GHz and mmWave to increase network capacity, data rates with better energy efficiency and TCO. GaN opportunity scales with number of antenna elements. GaN market will grow from ~$350 million in 2020E to ~$550 million in 2023E (15-20 percent CAGR).

5G smartphone complexity benefits the RF market leaders such as Qorvo, Skyworks, Broadcom, etc. The market is growing at 10-12 percent CAGR (2019-2022E). 5G smartphone estimates are growing from 2020’s 225 million to 2022’s 725 million. Ramp of 5G to meaningfully increase RF market opportunity primarily on new sub-6 GHz content, millimeter wave, are also additive over the next few years. There will be ~$5-$7 of incremental 5G sub-6 GHz content. This is positive for Qorvo, Skyworks, Broadcom, etc. Core base component expertise will grow, across PAs, switches, premium filters, etc. It is difficult to insource with lack of foundry model/merchant filter vendors.

Memory growth

Demand growth has been accelerating in memory. Pricing should improve meaningfully in DRAM in early 2021, while price declines in NAND are still moderate. Bit demand in DRAM and NAND should accelerate in 2021. DRAM bit demand should increase to >20 percent with strong demand for server and mobile DRAM. The NAND bit demand should increase to ~40 percent led by SSDs and mobile devices.

There is supply tightness in DRAM, as a result of lower DRAM capex in past two years. It should lead to improved pricing and ASP increases in 2021. NAND market is still in oversupply. ASP declines are set to decelerate later in 2021.

Capital intensity has been increasing across the device types. This is a positive for semiconductor equipment. Increasing capex should drive bit growth for DRAM and NAND. NAND capital intensity for 12X layer should be >50 percent higher than 4X layer NAND. This will require increasing the capex to drive bit growth for DRAM and NAND. Capital intensity is also increasing for foundry/logic, even as EUV has begun ramping. There is 5nm capital intensity that is >50 percent higher than 14nm/16nm. Increasing capital intensity is positive for semiconductor equipment companies, as spending on equipment will likely have a higher floor and be less cyclical over the next several years.

Looking at the wafer fab equipment (WFE) forecast and key programs for semiconductor manufacturers in 2021, we estimate WFE spending is on track to increase by ~16 percent in 2021 to nearly $70 billion.

We expect memory to recover in 2021 led by DRAM on improving supply/demand fundamentals with foundry/logic spending sustainable. Key drivers include following muted memory WFE in 2020 that was held back on supply discipline, we expect memory spending to accelerate to double-digit percent in 2021 led by DRAM. We expect continued foundry/logic spending strength in 2021. This will be broad-based across leading and lagging edge technologies. China spending should remain strong in 2021 as local manufacturers come up the learning curve.

Semiconductor industry could be worth trillion dollars by 2036

Semiconductor Industry Association (SIA) held a conference to make sense of the trends that shaped the global semiconductor market in 2020, and look ahead to what is in store for 2021.

The participants were Andrea Lati, VP, Market Research, VLSI Research, Dale Ford, Chief Analyst, Electronic Components Industry Association (ECIA), and CJ Muse, Senior MD, Head of Global Semiconductor Research, Evercore ISI. Falan Yinug, Director, Industry Statistics and Economic Policy, Semiconductor Industry Association, was the moderator.

Tough 2020!

Andrea Lati, VLSI Research, said that for the IC trend, the growth has accelerated since November 2020 as component shortages had strengthened prices. DRAM and NAND started 2020 very strong. They dropped during the middle of the year. The rebound happened during H2-2020.

IC recovery has since been sustainable, including for analog, power, etc. IC inventories have also been improving. They were running 8 percent above a year ago, in December 2020. The chip price performance index (CPPI) was relatively flat in 2020 despite high inventories in memory. Steady increase in Q4-2020 bodes well for 2021 prospects.

Dale Ford, ECIA, said there was a whipsaw disaster in 2020 that required a nimble response. There was a supply chain impact in 2020 due to the government quarantine orders and directives on company’s workforce and operations. Things calmed down after a time. The index of concern was quite high by August 2020, but, it is now coming down. Q4-2020 data will see numbers improve.

CJ Muse, Evercore ISI, said the semiconductor industry had gone through a correction in 2019. We were set up very well during 2020. Things were not as bad as feared in 2020. TSMC revenues were flat in April. There was an over reaction in automotive production. By September, TSMC-Huawei embargo had happened.

What’s ahead in 2021?

Andrea Lati noted that there will be continued worldwide GDP growth in CY21 from 2H20. Cloud and hyperscale datacenter will be a key drivers for the semiconductor industry. Hyperscale capex is at an all-time high. Cloud investments are supported by strong financial performance. 5G proliferation will be another big driver. 5G smartphone shipments will double in 2021. There will be increasing deployments for 5G base stations.

VLSI Research has forecasted 12 percent growth in semiconductors for 2021. Memory will lead the way. There will be continued recovery in auto, industrial, etc. Capex remained top-heavy despite increased spending by Chinese manufacturers. TSMC will definitely increase the capex, along with Intel, among the top 10 spenders. Semiconductor and equipment recovery is on track. There is buildout of IT infrastructure, 5nm demand ramp, 5G growth, memory capacity buildout, etc.

Trillion-dollar industry by 2036?

Dale Ford felt that the annual revenue cycle trends are up, starting from Sept. 2019. Annual revenue growth profile continued steady through 2020. It broke positive in August 2020. There are now strong demand and technology drivers. Semiconductors sit right at the top of the profile. Average lead times have also improved, especially, for controllers and processors. There was an upward trend in analog and logic components. The demand for discrete components and automotive components are also in the news.

There has been solid start to the current cycle. Most cycles last about four years. The technology/market forces are aligning to support growth in 2020+. Semiconductor industry has become much more responsive to the market indicators. We have an opportunity to see the ‘swoosh’ scenario. There are concerns about the global economy. However, electronics and semiconductors have been the biggest beneficiaries of the free trade.

The long-term semiconductor growth trends are moving toward $439-$472 billion by January 2021. It can easily move to $750 billion by 2030, and perhaps, a trillion dollars by 2036. Some positives include medical equipment, data centers, telecom infrastructure and 5G, solid-state drives, touchless solutions, memory, and sensors. The triumvirate of cloud, 5G and IoT, will make the long-term future looks very bright.

CJ Muse said there was higher OSAT pricing throughout the year. PCs grew 13 percent in 2020. It will probably be flat in 2021. Semiconductors are benefitting from being the component for the new economy. There will be 30 percent growth in DRAM and 12 percent growth in NAND. Industrial is just beginning to recover. IoT and smartphone are going to see huge growth. The party is just getting started. 2021 will be a great year, followed by 2022. There will be more supply, leading to some buffer stocks.

The world economy is depending on semiconductors, as the last year has shown. The impact going forward, will be on the supply chain. There are applications of AI for supply chain management, and key performance indicators and predictors. We need to deal better with the Black Swan events in the future. The SIA is also looking at a study on the supply chain, which will be coming out soon.

Automotive issues

Ford added that the Covid-19 crisis needed agile and nimble response. We are dealing with an industry that deals with how long it takes to produce a chip. Automotive lines were being shut down. Demand came back stronger, than expected. They need products built on 200mm. Investments have been more on the leading-edge technologies.

For lack of a low-cost component, other things can get held up. TSMC, UMC, etc., are taking some steps, but that won’t solve matters that easily. There are challenging questions regarding chips that automotives need. Muse remarked that semiconductor contracts with automotive manufacturers are long lasting. These chips are built for the different vehicles. Chip makers may want to cut supply.

Semicon spends healthy

Andrea Lati noted that spending levels have been healthy. China has also come up strong. TSMC, Samsung, etc., are seeing sectoral trends. They anticipate greater demand ahead. We are looking at tight market conditions. We may end up looking good in 2021. That should drive more capacity increases.

Long-term growth factors for the global semiconductor industry are there. Dale Ford felt that the future is bright. There have been many products that have shaped the world. The markets won’t fail in the future for the lack of innovation and technology.

Lati felt there could be some geopolitical risks in some parts of the world. Muse added that rising prices will occur in 2021. Ford added that there can be a policy of bifurcation with China. There could be changes in supply chain, and that could be a concern.

TSMC, UMC in green for March! Global semicon growth down!!

In what may be termed as some good news, two leading semiconductor wafer fab companies, based in Taiwan, have recorded positive increases for March 2020.

TSMC announced net revenues for March 2020 on April 10. On a consolidated basis, revenues for March 2020 were approximately NT$113.52 billion, an increase of 21.5 percent from February 2020 and an increase of 42.4 percent from March 2019. Revenues for January through March 2020 totalled NT$310.60 billion, an increase of 42 percent compared to same period in 2019.

TSMC announced net revenues for March 2020 on April 10. On a consolidated basis, revenues for March 2020 were approximately NT$113.52 billion, an increase of 21.5 percent from February 2020 and an increase of 42.4 percent from March 2019. Revenues for January through March 2020 totalled NT$310.60 billion, an increase of 42 percent compared to same period in 2019.

UMC, another leading global semiconductor foundry from Taiwan, recorded net sales of NT$ 14,570,408 in March 2020, as against NT$ 10,325,739 in March 2019, and NT$ 13,606,421 in March 2021.

TSMC’s Q1 2020 earnings release conference will be held on April 16, 2020, at 2 pm Taiwan time. UMC will hold its Q1 2020 earnings release and investor conference call on April 27, 2020. TSMC also has plans to build beyond-5nm logic technology platform and applications, for 6th generation FinFET CMOS technology platform for SoC, in 2021.

Global semicon growth hit

VLSI Research’s projection expects a big hit to the semiconductor industry in 1H20, followed by recovery in H2. In case the recovery is delayed, declines in electronics, ICs and equipment will be far greater. The falling end demand will see half the IC recovery, and keep the IC market in the red, in the near term. VLSI Research puts mild-Covid 19, with delayed recovery in 4Q20. But, it also puts severe Covid-19 impact and recovery in 1Q21.

As per the latest data from Statista, the forecast predicts a worst case scenario of a 12 percent or more decline to global semiconductor industry revenues, as impacted by Covid-19 outbreak. It will bring serious implications for the wider technology industry. The technology supply chain would take approximately 3 months to recover, while the global disruption to the economy and technology demand would likely last for at least 12 months.

Industry should stay up and running

The Semiconductor Industry Association (SIA) released a statement from president and  CEO John Neuffer commending congressional approval and enactment of the Coronavirus Aid, Relief, and Economic Security (CARES) Act recovery package. SIA represents U.S. leadership in semiconductor manufacturing, design, and research, with members accounting for approximately 95 percent of US semiconductor company sales.

CEO John Neuffer commending congressional approval and enactment of the Coronavirus Aid, Relief, and Economic Security (CARES) Act recovery package. SIA represents U.S. leadership in semiconductor manufacturing, design, and research, with members accounting for approximately 95 percent of US semiconductor company sales.

In a paper titled: Why the Semiconductor Industry Must Stay Up and Running as We Confront COVID-19, the SIA has called on all governments around the world, at all levels – central, states/provinces, and localities – to prioritize continued operations for their domestic semiconductor companies and their suppliers by defining the semiconductor industry and its supply chain as “essential infrastructure” and/or “essential business.

AMCHAM, CSIA, ESIA, JSIA, KSIA, SEIPI, SEMI, SIA, SSIA, and TSIA have together called on nations to prioritize essential supply chain operations during Covid-19.

A release said: “We call on all governments to specify semiconductor industry operations as “essential infrastructure” and/or “essential business” to allow continuity in operations of an industry that powers our global digital infrastructure and underpins vital sectors of the economy.”

Yole Développement, in a report, says that the NAND and DRAM outlook appears favorable in 2020. Let’s see!

Robot disinfects large areas

In another development, a robot capable of rapidly disinfecting large areas has been invented by Forth Engineering in Cumbria, a world-first solutions business, to speed-up the fight against coronavirus.

Forth Engineering is known for its innovations to solve complex industry challenges in the nuclear, oil and gas, renewables and other sectors all over the world. Forth MD, Mark Telford, and his team have responded to the fight against COVID-19 by inventing a remotely-operated disinfecting robot.

Perhaps, the world has forgotten one simple line: everything runs on chips, or ICs, or semiconductors. If no semiconductors, then, nothing remains! And, that definitely will never happen!! Here’s how!

Steep rise in memory, RPA, Industry 4.0

Folks, expect a steep rise in memory and memory-related products. Especially, DRAM and NAND! There will probably be a huge demand for products and computers that are high on memory.

We may see a rise in RPA-related products. Industry 4.0 may gather steam as companies will now look to automate several or all processes across industries. Same for blockchain and delivery drones, and probably, self-driving cars. Perhaps, there may be more focus on smart cities as well.

There could be a rising demand for cloud-based application security solutions. As would high-performance computing. With it, servers, with even more storage. We may also see more connected enterprises in the future. Life sciences will probably go full speed, as could electric vehicles and hybrid electric vehicles.

Automotive, consumer goods, electronic components electronics, medical equipment and supplies, pharmaceuticals, may undergo a sea change as companies may look at other avenues, besides China. There may be, and should be, even more innovations happening, once Covid-19 has been tackled properly. Needless to add, remote working and online entertainment are bound to grow.

Expect, China to be at a receiving end in Asia as several companies will look for alternative bases, besides China. There could be lot of office space, now that social distancing is a norm.

One hopes to hear some more good news from the global semiconductor industry, despite these tough times.

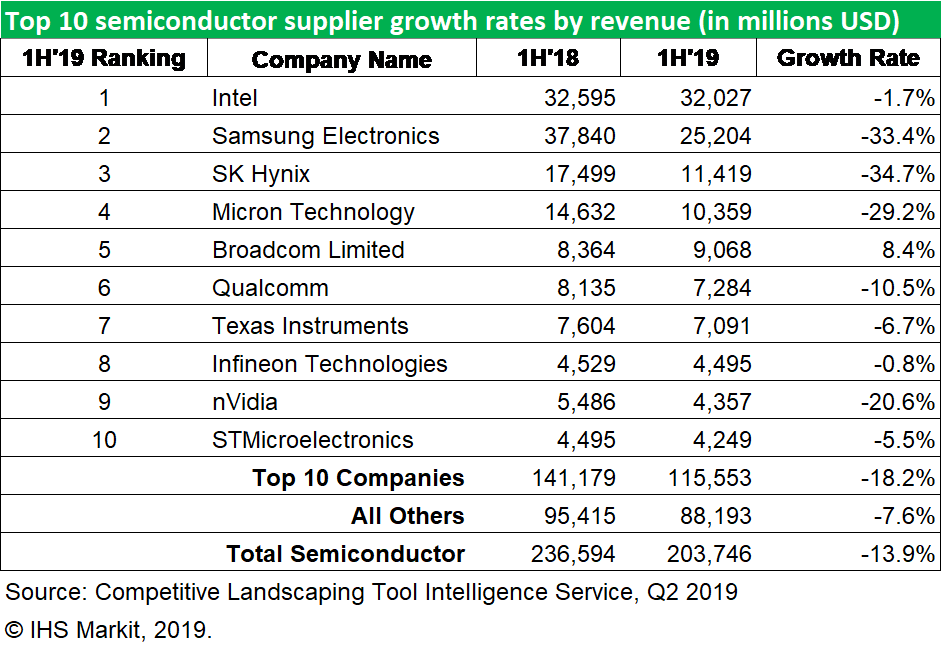

Global semicon chip sales plunges 13.9pc in H1 2019; 5.5pc growth forecast for 2020

Global semiconductor chip sales plunged by 13.9 percent during the initial six months of 2019, compared to a year earlier, the biggest drop in a half since the first half of 2009 — exactly a decade ago, according to IHS Markit.

Major chip suppliers suffered their worst revenue declines in years—10 years in some cases. Major semiconductor product areas also experienced the largest drops in demand since 2009.

Global semiconductor revenue in the first half totaled $203.7 billion, down from $236.6 billion in the first half of 2018. This represents the worst performance since the market declined by 26.5 percent in H1 of 2009.

Chip debacle?

First, wasn’t the chip debacle expected? Yes, said Ron Ellwanger, senior Research analyst, IHS Markit, USA. “In late 2018, IHS Markit had forecasted a significant decline in semiconductor revenue in 2019. Semiconductor inventory was high and demand was weak. We didn’t foresee any compelling new product to stimulate consumer demand and growth.”

So, what is the main reason for the precipitous drop in memory segment? And, is there a way out? According to Ron Ellwanger, they are overcapacity and weakend market demands. As the datacenter and handset markets recover, the existing capacity will be in utilized.

Again, what are the reasons for the drop in data processing? He said that data processing tends to refer to the PC market. The PC market continues to be negatively affected by smartphones. Servers and data centers were simply overbuilt. “As capacity is utilized, the next wave of build out will occur. We expect that to start in early 2020.”

Next, what are the reasons for the revenue declines in logic, sensors and actuators? Ellwanger said that there was a lack of new products that captured consumer interest, which increases demand. This caused the chip companies to see a decline in their orders. The market needs new compelling products for consumers to re-enter the market.

Is there any advice for the application markets that purchase semiconductors? He noted that application markets must develop new products that stimulate consumer’s desire to acquire the new device. Evolutionary products are not causing consumers to purchase the next generation gadget.

Forecast 2020

Finally, what is IHS Markit’s forecast for the global semicon industry for the end 2019, and full 2020? Ellwanger said: “The current IHS Markit forecast will be updated by the end of September 2019. Our existing forecast for 2019 is -12.5 percent, and we anticipate that this may further degrade.

“The current forecast for the global semiconductor industry for 2020 is 5.5 percent. We believe that this will be in the range of our new forecast.”

Global semiconductor market in worst-in-a-decade downturn in 2019: IHS Markit

Conditions in the global semiconductor market have deteriorated rapidly since the start of the year. In fact, IHS Markit, USA, is slashing its 2019 growth outlook for global semiconductor market by more than 10 percentage points.

Myson Robles Bruce

The worldwide microchip industry is set to suffer a 7.4 percent drop in revenue this year, according to the latest figures from the IHS Markit Application Market Forecast Tool (AMFT). Revenue will very likely fall to $446.2 billion in 2019, down from $482.0 billion in 2018.

So, why has IHS Markit predicted that semiconductor market is lurching into downturn in 2019? Didn’t it have some good years recently?

Myson Robles Bruce, semiconductor value chain research manager, at IHS Markit, said: “Yes, 2017 and 2018 were high growth years in the industry due mostly to revenue generated by higher Memory IC pricing. In 2018, more than a third of all semiconductors revenue came from memory ICs, so when pricing on these components fell late last year and early this year, due to oversupply, the effect was a highly negative impact on the overall market.

“However, the downturn in 2019 might not last very long, depending upon how much recovery later in the year and the effect of macro factors next year like the global economy.”

Segments affected

Which are the segments, specifically, that will be affected? According to him, the IHS Markit Q1 2019 AMFT had memory ICs down -14.5 percent sequentially for the first quarter, and it now seems that actual results were much worse. For total semiconductor revenue, the first quarter was expected to be at -9.6 percent, but it was likely 3-6 percent lower. IHS Markit CLT will confirm this by end of May publication. If first quarter of 2019 was that much lower than expected, then the year overall could fall to a double-digit decline.

“For different macro and micro reasons, automotive electronics, industrial electronics, consumer, computing (including data center) and wireless (smartphones) all found growth in Q1 2019 difficult, even taking into account the usual seasonal patterns. The most significant problem is too much memory IC inventory and not enough current applications demand, and most of the other semiconductor categories are affected as well at least to some extent,” he added.

Recovery in sight?

In that case, when will there be some recovery? He said: “Recovery could happen in the second half of the year starting in Q3, and it would be led by memory ICs. If this is the trend, then there will be signs of memory growth appearing in Q2. NAND inventory is expected to be reduced enough by Q3 that the currently very aggressive pricing will be returned to normal levels.

“The increased demand from high-tier smartphones is a factor in both DRAM and NAND growth, but in NAND, the amount of bit growth will be higher than for DRAM and that should produce greater revenue growth. The largest application for NAND memory is solid-state drives, which is expected to contribute strongly later this year and in 2020. These devices are used in both data centers and notebook PCs.”

And, what are the segments that will be responsible for the recovery? While it is challenging to find significant applications demand that would help semiconductor revenue for this year overall, but it could happen to some extent with 5G network implementations, and by way of high-tier smartphone sales outside the US market.

“IHS Markit considers high-tier smartphones to be priced at $400 or more, which includes handset models from Apple and Samsung for sure, along with units from other brands like Huawei. Also, a possibility that increased data center server shipments in H2 2019 will drive stronger revenue for memory ICs and MPUs especially,” he added.

Forecast for 2019 and 2020

What is the end year forecast for semicon? What is IHS Markit’s outlook for 2020? Bruce said: “As of March 2019, this year was predicted to end at -7.4 percent, with 2020 up by 3.5 percent. However, the forecast as of end of June for the IHS Markit Q2 2019 AMFT will likely indicate even lower growth this year followed by higher growth next year as compared to the previous update.

“The emerging 5G technology will be a growth driver next year (networks and smartphones), along with continued growth in data centers and automotive electronics. In automotive, though global car sales are declining, the electronics per vehicle (and therefore, semiconductor content) is increasing rapidly.”

Finally, a welcome back to a very good friend, Jonathan Cassell, to IHS Markit, USA.

— By Ms Aanchal Ghatak and Pradeep Chakraborty