Month: September 2018

SnapEDA-Samtec to accelerate design process

Samtec is releasing new digital models for over 100,000 of its products on SnapEDA, the industry-leading circuit board design library. Traditionally, designers have spent days creating digital models – such as symbols and footprints – for each component in their respective designs.

With this Samtec-SnapEDA collaboration, designers can now easily discover, download, and design with over 100,000 ready-to-use Samtec connector models, helping accelerate the design process. The new models include USB, card edge, board-to-board, headers, and RF coaxial connectors.

With this Samtec-SnapEDA collaboration, designers can now easily discover, download, and design with over 100,000 ready-to-use Samtec connector models, helping accelerate the design process. The new models include USB, card edge, board-to-board, headers, and RF coaxial connectors.

Elizabeth Bustamante, CAD Manager, SnapEDA, spoke from San Francisco, USA, on why Samtec chose to go with SnapEDA. She said: “We’re thrilled to work with Samtec because they are one of the most in-demand connector manufacturers on SnapEDA. Our users will benefit greatly from these new PCB libraries that will save them days of time, and allow them to quickly design-in Samtec parts.

“Samtec chose SnapEDA because over half a million engineers use SnapEDA each year to select and design-in parts into their designs. With our massive community of hardware designers, and their high-quality components that are high in demand with our community, it was the perfect match.”

Competing against existing models

How will Samtec compete against other such existing models? She added: “It’s not so much that Samtec is competing to get their models into a design, but rather, their physical products. The digital model (or, what are in fact, manufacturing files), are really when they design-in comes to fruition.

“Samtec has high-quality and reliable products, and an incredible focus on service and support. I think, that’s why so many engineers trust their products. Ultimately, engineers will make the decision based on which specs are right for them, and the model is really the ‘icing on the cake’, after they’ve made that selection decision as a reward to help them design it in more easily.”

Samtec has over 100,000 new models on SnapEDA. The new models include USB, card edge, board-to-board, headers, and RF coaxial connectors, because the new models include USB, card edge, board-to-board, headers, and RF coaxial connectors. Since Samtec focuses on connectivity solutions, that’s where the focus was for this project. However, SnapEDA has millions of models for all kinds of products.

Boosting electronics designers’ productivity

How can electronics designers boost their productivity with free symbols and footprints for Samtec products? Elizabeth Bustamante said: “Finding high-quality models for the exact part number, in the exact format and version you need is actually quite difficult. With these models, Samtec’s Signal Integrity Team is working directly with defining every element.

“Additionally, SnapEDA’s translation technology ensures that it is available in every format. The commitment to quality, and the breadth of our database and design formats supported is why we’re the #1 parts library on the web in terms of traffic.

“On top of this, creating connector models (which these are) are especially time-consuming, due to their non-standard shapes, pitches, pads, and cutouts regions. Having these models available to download, designers can spend more time in improving their design, allowing them to focus on optimization and innovation.”

Finally, how are newer, unreleased digital models going to be handled? She said: “We have a popular service, called InstaPart, which allows the engineers to request any models in 24 hours, and fulfilled by SnapEDA’s in-house component engineering team. Furthermore, the SnapEDA and Samtec teams are working closely to deploy new models to the SnapEDA platform as they become available.”

It is really great to have a lady address the queries on behalf of an organization. Many congratulations to the SnapEDA-Samtec combine.

Opportunities in Greek solar PV market

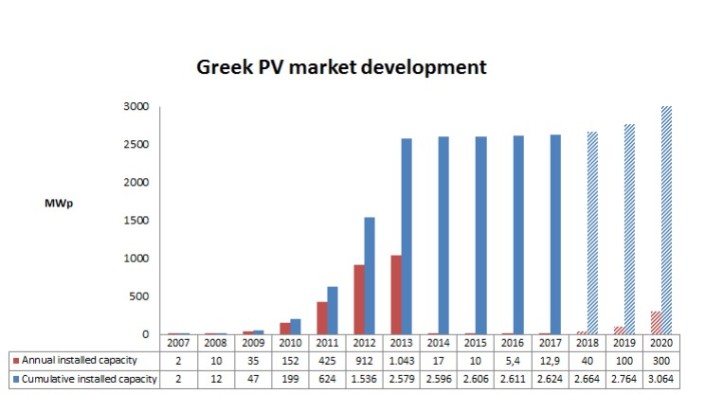

The Greek solar market took off in 2006 when feed-in tariffs (FiTs) were introduced for PV, said Stelios Psomas, Policy Advisor, Hellenic Association of Photovoltaic Companies (HELAPCO). He was speaking at a webinar held recently on the solar PV market in Greece, organized by Solarplaza.

There were simple authorization procedures in 2010, followed by a market boom during 2011-2013. Years 2013-14 saw retrocative FiT cuts and freezing of new projects. In 2016, tenders were introduced and there was the first pilot tender. Now, in 2018, we are seeing tenders becoming the norm, and costs going down.

There have been some remarkable figures. Now, 7 percent of the electricity demand in Greece is covered by PV, bringing Greece to the third place worldwide with regard to PV contribution to electricity needs. Greece ranks 5th worldwide with regard to the installed PV capacity per capita. About €5 billion has been invested in PV so far in Greece.

Despite the retroactive cuts back in 2014, project returns remained high for asset owners, and the bankability of their projects remained intact. In fact, even after the FiT reductions, the PV market in Greece has the lowest non-performing loan track record (there are practically no NPLs in the sector).

Regulatory risks have been eliminated. As on June 16th, 2016, the Greek Government agreed on a supplementary MoU with its creditors, which tried to put an end to the previous uncertainty. According to this MoU: “By June 2016, the authorities will: (iii) as a milestone amend the current legislation on ETMEAR and/or the structure of the RES account while respecting existing contracts in line with European Union rules, to ensure that the debt in the RES account is eliminated over a 12-months forward looking horizon (not later than June 2017); the account will be kept annually in balance onward”.

The RES account had a surplus by the end of 2017, and is expected to be kept in balance from now on. A long-term energy planning is underway now in Greece. The preliminary target for PV till 2030 is 6-6.5 GWp. This translates to an average annual market of 300 MWp.

A new support scheme for renewable energy, consistent with the guidelines on State aid for environmental protection and energy 2014-2020 (based on competitive tenders and feed-in-premiums) was introduced in 2016. A pilot auction for 40 MWp took place in December 2016, and another one on July 2nd, 2018.

Results of latest auction (July 2nd, 2018)

Category Ι (<1 MWp)

* 83 projects approved (total capacity 53. 5 MWp)

* Min price: 75.87 €/MWh

* Max price: 80 €/MWh

* Avg. price: 78.4 €/MWh

Category Ι I (>1 MWp)

* 8 projects approved (total capacity 52.9 MWp)

* Min price: 62.97 €/MWh

* Max price: 71 €/MWh

* Avg. price: 63.8 €/MWh.

The next auction is due for Q4-2018.

Read the rest of this entry »

Time for action in Colombian PV market!

Solarplaza recently held a webinar, titled PV in Colombia. Marc Tremel, GM, Colombinvest, discussed distributed generation (DG) as a trailblazer. Colombinvest provides solar EPC (IPP) for 0.1 MW up to 1.5 MW. It also has +25 PV projects realized YTD (~ 0.23 MW).

As for the DG marketing in Colombia, there are distributed generation for residential (< 10 kWp), commercial (< 100 kWp), and industrial (< 1 MWp). The current market size is around 20 MW DG plants that have been built, and around 100 MW DG in pipeline.

As for the DG marketing in Colombia, there are distributed generation for residential (< 10 kWp), commercial (< 100 kWp), and industrial (< 1 MWp). The current market size is around 20 MW DG plants that have been built, and around 100 MW DG in pipeline.

Major regions developed include:

* Center region (Andina) -Bogota and surroundings

* Coastal region –Barranquilla and surroundings

* Pacific region –Cali and surroundings

* Further development in other regions of the country.

Important regulation in place are the CREG 030 (March 2018). Under this, there is

< 100 kW net-billing without“C” (Commercialization) of the whole energy tariff (about 85-90 percent of the wholesale price). In 100 kW and 1 MW, the net-billing is only with “G” (Generation) price (about 30-40 percent of the wholesale price). In above 1 MW, there are same rules, but stricter measurements (irradiation measurements) on an hourly basis on-site, and stricter grid rules.

In CREG 015 (March 2018), in < 100 kW, there is no obligation for backup contract. In

above 100 kW, the obligation to sign backup contract with grid operator, and value is depending on the project and the grid operator and costs.

Grid operator regulation CREG 030 gives new obligations to each solar system. Every single solar system requires a full RETIE (local electrical code) certification. However, RETIE does not include any specific PV section.

Most “common practice” is copied by NEC 2017 or some European codes. By exporting energy to the grid, the timing for the grid operator approval > 30 days. Even the systems <100 kW require an hourly energy measurement. Before grid connection is approved, an utility inspector makes on-site visits.

As for the major players in the market, they include Celsia (Grupo Argos), EPM, Codensa (ENEL Group), and smaller utilities (Vatia, EMCALI, etc.) among utilities. International EPC companies such as Panasonic, Green Yellow, and several mid-sized companies are present.

Challenges and opportunities

Some key challenges in the market:

* No long-term energy contracting in Colombia. PPA for 10 years or less.

* Local knowledge about solar is still lacking (specially on the authority side).

* Grid operators, UPME, ANLA require too much bureaucracy (too high administration costs).

* No clear rules about technical requirements -> no real “RETIE standard”.

* Grid connection studies require too much time.

Some key opportunities in the market:

* There is still space for well-positioned international players (EPCs, IPPs).

* Very interesting market space for distribution companies.

* Spreading commercial plants (< 100 kW) with interesting PPA models.

* Industrials are just waking up.

* New government can be helpful to push things ahead.

Read the rest of this entry »

SiFive presents RISC-V product overview

SiFive recently presented the RISC-V product overview. Krste Asanovic, co-founder and chief architect, said: “Have you ever heard of a $1 billion hardware company with 13 employees? Instagram turned into a $1 billion acquisition with only 13 employees.

“SiFive provides RISC-V core IP. SiFive RISC-V core IP product offering includes E Cores and U Cores. E Cores are the industry leading 32- and 64-bit embedded cores. U Cores are the high performance 64-bit application cores.”

The Core Series offer unique design points which can be customized for application-specific requirements. Standard Cores are pre-configured implementations of Core Series, free RTL and FPGA evaluations.

E2 Series RISC-V Core IP

SiFive E2 Series RISC-V Core IP is SiFive’s smallest, lowest power core series. It provides clean-sheet design from the inventors of RISC-V. It has a new interrupt controller enabling fast interrupt handling. It also has support for coherent heterogenous MP with other SiFive cores. The E20 and E21 are Standard Cores within the E2 series.

SiFive E2 Series RISC-V Core IP is SiFive’s smallest, lowest power core series. It provides clean-sheet design from the inventors of RISC-V. It has a new interrupt controller enabling fast interrupt handling. It also has support for coherent heterogenous MP with other SiFive cores. The E20 and E21 are Standard Cores within the E2 series.

E2 Series is the smallest, most efficient RISC-V MCU family. It is:

– RV32IMAFC capable core

– 2-3 stage, optional, Harvard Pipeline

It is configurable to meet application specific needs. It is the first RISC-V core with support for for the RISC-V Core local interrupt controller (CLIC). Drop In Cortex-M0+ and Cortex-M3/M4 replacement.

E21 is 12 percent higher performance per MHz vs Cortex-M4 in CoreMark, when using equivalent GCC Compilers. E20 is 28 percent higher performance per MHz vs Cortex-M0+ in CoreMark, when using equivalent GCC Compilers.

SiFiveE3 and E5 Series RISC-V Core IP are high performance 32-bit and 64-bit RISC-V MCUs. Features include pipelined multiapplication unit, multicore support, fast interrupts and memory protection.

U5 Series RISC-V Core IP

SiFive U5 Series RISC-V Core IP is 64-bit RISC-V Multicore Linux-capable. The U5-MC allows for instantiation of up to 9 U5 and/or E5 cores as well a configurable Level 2 cache. Flexible memory system allows for application-specific resource partitioning.

It has broad market applications – general-purpose embedded, industrial, IoT, high-performance real -time embedded, automotive.

The U54 -MC4 Standard Core is also 64-bit RISC-V multicore Linux capable.

“RISC -V delivers a platform for innovation, unshackled from the proprietary interface of the past. This freedom allows us to bring compute closer to data to optimize special-purpose compute capabilities targeted at Big Data and Fast Data applications,” according to Martin Fink, CTO, Western Digital.