HELAPCO

Opportunities in Greek solar PV market

The Greek solar market took off in 2006 when feed-in tariffs (FiTs) were introduced for PV, said Stelios Psomas, Policy Advisor, Hellenic Association of Photovoltaic Companies (HELAPCO). He was speaking at a webinar held recently on the solar PV market in Greece, organized by Solarplaza.

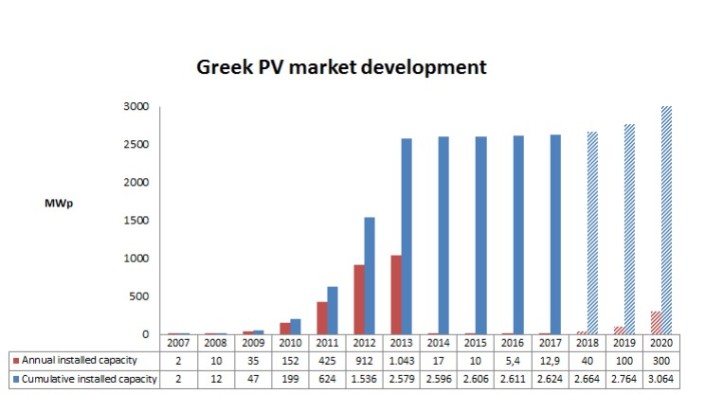

There were simple authorization procedures in 2010, followed by a market boom during 2011-2013. Years 2013-14 saw retrocative FiT cuts and freezing of new projects. In 2016, tenders were introduced and there was the first pilot tender. Now, in 2018, we are seeing tenders becoming the norm, and costs going down.

There have been some remarkable figures. Now, 7 percent of the electricity demand in Greece is covered by PV, bringing Greece to the third place worldwide with regard to PV contribution to electricity needs. Greece ranks 5th worldwide with regard to the installed PV capacity per capita. About €5 billion has been invested in PV so far in Greece.

Despite the retroactive cuts back in 2014, project returns remained high for asset owners, and the bankability of their projects remained intact. In fact, even after the FiT reductions, the PV market in Greece has the lowest non-performing loan track record (there are practically no NPLs in the sector).

Regulatory risks have been eliminated. As on June 16th, 2016, the Greek Government agreed on a supplementary MoU with its creditors, which tried to put an end to the previous uncertainty. According to this MoU: “By June 2016, the authorities will: (iii) as a milestone amend the current legislation on ETMEAR and/or the structure of the RES account while respecting existing contracts in line with European Union rules, to ensure that the debt in the RES account is eliminated over a 12-months forward looking horizon (not later than June 2017); the account will be kept annually in balance onward”.

The RES account had a surplus by the end of 2017, and is expected to be kept in balance from now on. A long-term energy planning is underway now in Greece. The preliminary target for PV till 2030 is 6-6.5 GWp. This translates to an average annual market of 300 MWp.

A new support scheme for renewable energy, consistent with the guidelines on State aid for environmental protection and energy 2014-2020 (based on competitive tenders and feed-in-premiums) was introduced in 2016. A pilot auction for 40 MWp took place in December 2016, and another one on July 2nd, 2018.

Results of latest auction (July 2nd, 2018)

Category Ι (<1 MWp)

* 83 projects approved (total capacity 53. 5 MWp)

* Min price: 75.87 €/MWh

* Max price: 80 €/MWh

* Avg. price: 78.4 €/MWh

Category Ι I (>1 MWp)

* 8 projects approved (total capacity 52.9 MWp)

* Min price: 62.97 €/MWh

* Max price: 71 €/MWh

* Avg. price: 63.8 €/MWh.

The next auction is due for Q4-2018.

Read the rest of this entry »