GenAI – next S-curve for semiconductor industry?

Generative artificial intelligence (GenAI) applications are becoming increasingly popular and with new model and applications being currently launched every day. However, GenAI applications are very compute intensive requiring specialized servers and chips.

SEMI, USA, organized a seminar today on GenAI – next S-curve for the semiconductor industry?

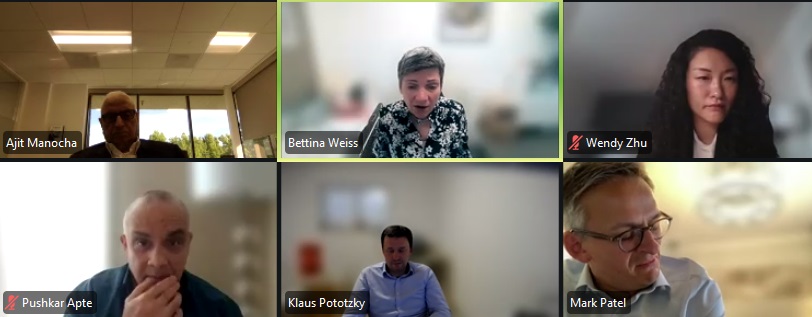

Ajit Manocha, President and CEO, SEMI introduced the speakers and welcomed guests. Mark Patel, Senior Partner, McKinsey & Co., said promise AI has long beckoned. AI will change everything, and transform industries. Diverse AI apps will lead to growth of global semiconductor industry crossing $1 trillion by 2030.

Semiconductors are fueling rapid AI acceleration. Virtuous cycle is leading to exponential growth, with more powerful chips leading to more powerful AI, and vice versa. This is just the beginning of a new era.

Pushkar Apte, Strategic Technology Advisor, Smart Data-AI, SEMI presented on the initiative. We are realizing the full value of data-AI revolution. AI hardware innovation will drive more powerful AI. Digital twins will build more powerful AI chips in future. We started proof-of-concept project in 2019. It is in phase 3 now. This is a digital twin driven virtual innovation environment. Standards will be absolutely critical here. We will accelerate virtuous innovation cycle.

We have full-day session on July 9 at Semicon West 2024 on future of computing. Focus will be on innovative AI hardware, and quantum sensing and computing. On July 10, there is a session on photonics on the edge. Presenters include Intel, IBM, Micron, McKinsey, Cornami, Nvidia, QED-C, Stanford University, VTT, Quantum Semiconductor, etc. We shall follow-up with in-depth workshop in fall.

Semiconductor industry outlook driven by GenAI was presented by Klaus Pototzky, Associate Partner, McKinsey & Company. We developed three adoption scenarios for GenAI demand by 2030. We looked at AI’s economic impact based on business use cases estimation.

Advanced analytics, traditional ML, and deep learning use cases account for 11-17.7 percent. New GenAI use cases make 6.1-7.9 percent. Total AI economic potential has 17.1-25.6 percent, respectively. GenAI can create an additional ~ 35 70 percent of value above what the other AI and analytics can unlock. GenAI compute demand has been rising rapidly as model complexity is growing faster than device performance.

We developed 3 adoption scenarios to forecast GenAI demand in 2030. These are: conservative, base case, and accelerated, at 24 percent, 30 percent, and 40 percent, respectively. For B2B apps, these will be 15 percent, 25 percent, and 40 percent, respectively. For B2C apps, these will be 6 percent, 11 percent, and 17 percent, respectively.

GenAI demand from B2B and B2C applications was translated into required servers, and then into data center capacity. For wafer demand, for each server archetype, the FLOP performance was estimated, based on which wafer demand (by chip type and node size) was derived. New fabs would be needed by 2030. Using average fab sizes and utilization benchmarks, wafer demand was converted into required number of new fabs to fulfill the GenAI demand in 2030.

Ondrej Burkacky, Senior Partner, McKinsey & Co., presented on implication for the ecosystem, GenAI data center demand by 2024-30. GenAI is estimated to represent majority of data center demand by 2030, by 52 percent. Access to electricity will be critical as total server demand capacity in 2030 corresponds to ~ 10 percent of global electricity consumption in 2030. GenAI will generate additional demand for wafers, especially for DRAM/HBM. Demand will be 2.4 million wafers for logic (7nm and below), 8.6-13.6 for DRAM, 4 for NAND, 0.4 for power, and 0.4 for connectivity, respectively.

GenAI demand corresponds to 20-24 additional 12”-equivalent fabs in 2030. Logic will require 6 fabs, DRAM 8-12 fabs, NAND 3 fabs, power 1 fab, and connectivity 2 fabs. Base case corresponds to $4-6 trillion capex investment need until 2030.

Silicon demand forecast and scenarios was presented by Wendy Zhu, McKinsey & Co. She said that ~50 percent of overall semiconductor market growth will be driven by GenAI until 2030. It is important to identify demand scenarios, opportunities and future supply chain bottlenecks, and financing growth.

Bettina Weiss, Chief of Staff & Corporate Strategy, took the questions from the audience.